How we help

Technology Consulting for Life Insurers

Whether you’re optimizing underwriting and claims processes or unlocking new potential through elevated digital experiences and artificial intelligence, we bring the expertise and insight you need to stay competitive.

What role does IT play in your organization, and how can you best leverage technology to keep up with the industry?

Our technology experts work alongside your business and IT departments to assess your current state and identify avenues for real change and growth, whether it’s rearchitecting existing technologies, enabling innovative capabilities, making better use of your data or reaching customers more effectively.

Specialized in experience design, architecture, data and artificial intelligence, our team is equipped to help chart your path forward — starting with a strong technology strategy.

WAYS WE CAN HELP

- Data Strategy & Roadmaps

- Solution Architecture

- Enterprise Architecture

- Technology Advisory

- AI Workshops & Advisory

How can we help your IT systems communicate information more efficiently and effectively? Through trusted advisory and software development, our team targets opportunities to improve business process efficiency, reduce technical debt and enable new capabilities.

Whether you’re challenged with enterprise alignment, a limited tech stack or the sheer scale of your project, our experts simplify, guide and redirect to keep your modernization journey on track.

WAYS WE CAN HELP

- Billing & Payments

- Reporting & Analytics

- Claims & Underwriting

- Policy Administration

Leverage data and analytics internally and externally, with ease and simplicity. Beyond knowing your customers, we help life insurers curate useful data to gain a 360-degree view of their business landscape, agents and brokers.

Together, let’s build foundational analytics strategies, build and optimize modern data platforms, reduce overlapping data assets and process inefficiencies and embed useful insights in every step of the decision-making process.

Let’s find your AI advantage. Introducing automated and augmented processes can help life insurers significantly cut costs, more accurately assess risk, detect claims outliers and improve accuracy, while also delivering better, more personalized experiences to your customers.

Our AI experts help identify the best use cases for AI, integrating with your team to understand where AI can make a measurable impact while addressing bias, fairness and data drift.

WAYS WE CAN HELP

- AI Workshops & Prototyping

- Bias & Fairness

- AI as a Service

- Model Assessment & Audit

- Claims & Underwriting Automation

When your customers only engage once or twice per year, every touchpoint matters. Our experience designers help you replace traditional customer experience frameworks to deliver best-in-class omnichannel experiences, helping you understand real customers’ needs and exceed expectations.

Create more personalized interfaces, streamline communication channels and optimize user workflows to satisfy customers and improve operational efficiency.

WAYS WE CAN HELP

- Policyholder Engagement

- Claims Administration

- Billing & Payments

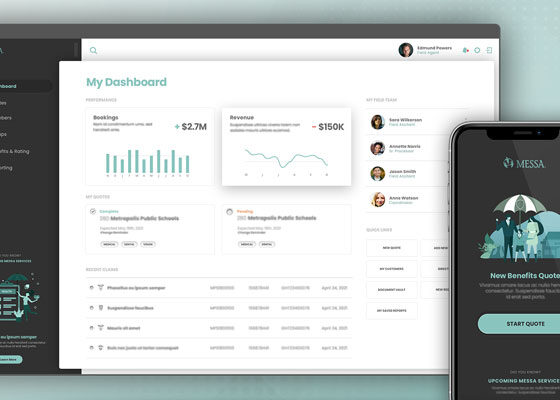

- Agent-Broker Experience

Serving leading life and annuity insurers for over 25 years.

Case Studies

Contact

Start the Conversation

Whether you need an unbiased perspective on a current project, are exploring a new initiative or aren’t sure where to start, let’s talk.

David Ollila

Principal,

Insurance Lead

A seasoned insurance expert and trusted client advisor, David has excelled as a go-to client liaison, advisor and advocate for nearly 20 years. Throughout his career, he’s collaborated closely with leaders across the domain to address their pressing needs and challenges, centering technology in his approach to help them chart a path forward. Project strategy, experience design, data and technology — David engages clients at any stage to ensure they're embracing innovation the right way.