From Vision to Launch: Helping a Traditional Insurer Go Digital

One client's journey to a first-of-its-kind, direct to consumer permanent life insurance product.

The Client

A Leading Annuity &

Mutual Fund Provider

The Business Objective

The newest generation of life insurance customers seek out digital, hassle-free buying and issuance processes, yet few insurance options on the market deliver. Our client, a longtime leader in the U.S. retirement and annuities market, approached X by 2 with a first-of-its-kind vision designed to exceed the demands of the digital customer: a direct to consumer, permanent life insurance channel.

Targeting customers from 18 to 45 years old, our client needed an impressive, yet simplified, user experience and engagement model capable of generating interest, maintaining customer loyalty and servicing a unique demographic. However, as a 130-year-old company with few existing capabilities in the life insurance market, our client faced a wide range of obstacles and efficiency gaps.

The Business Impact

- Instant Underwriting

Enabled seamless underwriting with AI-driven application processing and pre- and post-issuance predictive modeling.

- Technology Enablement

Selected solutions and technology to support CRM, marketing and underwriting automation, data analytics, needs analysis, quoting and illustration, and eApp.

- Agile Implementation

Leveraged design thinking methods to enable agile development, market testing, and iteration, launching six months ahead of schedule.

The Work

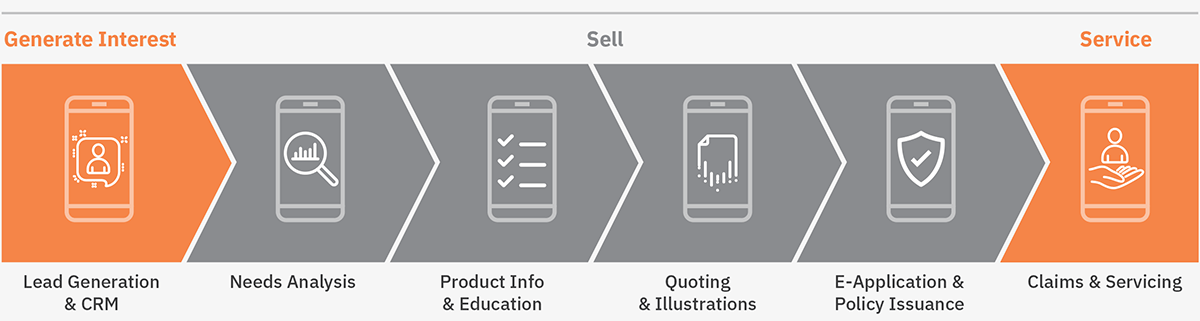

X by 2 provided strategy and advisory, technology enablement, and implementation oversight, taking the client from vision to successful project launch.

Technology Advisory & Strategy

- Identified capabilities required to fulfill the client’s digital strategy

- Created a future state architecture with a cloud- first approach

- Identified gaps between current and desired capabilities

- Identified technology solutions with selective custom-build components to fill gaps and create a competitive advantage

- Created service- and event-based integration architectures

- Provided a reference architecture for a cloud-based data and analytics platform

- Oversaw implementation of technology solutions, ensuring our client developed the capabilities required to deliver the digital strategy

Instant Underwriting

- Designed and implemented a low-cost, instant decision underwriting solution without compromising accuracy

- Enabled predictive, data-driven risk profiling with post-issuance rechecks to support the underwriting solution

User Experience & Journey

- Realized the customer experience vision by mapping end-user capabilities to components in the future state architecture

- Designed key aspects of the customer journey to create a seamless experience between systems in the sales funnel

- Designed digital nudges to guide customers through the sales funnel

- Implemented marketing tools to track lead source, engagement, conversion, and revenue and cost attribution

The Business Outcome

Providing the necessary life insurance and technology expertise, X by 2 turned the client’s vision into an agile, end-to-end technology ecosystem designed to simplify underwriting and buying processes and deliver a first- class digital experience.

Recommended Content

End-to-End Insurance Technology Ecosystem