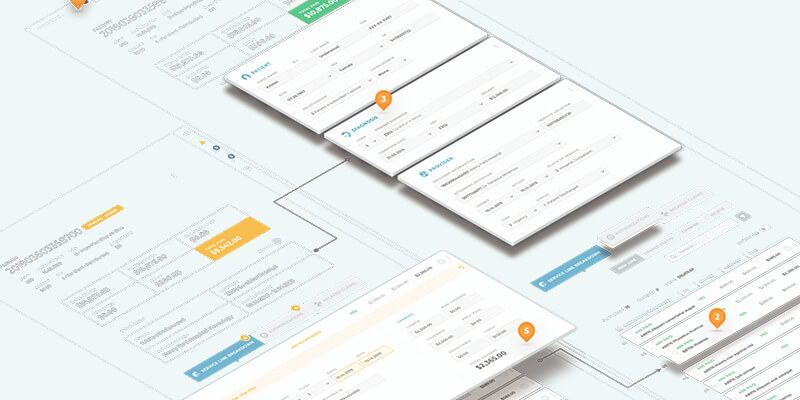

- Multiple editable copies of customer data and Customer IDs in use.

- Quality improvements happening downstream not feeding back into source-systems.

- Stability and latency issues due to the many hops data had to travel.

- Difficult to implement data governance and qualitymanagement due to lengthy value-chain.

BUSINESS CONTEXT

The customer is a diversified family of financial services companies offering life insurance, annuity and investment products for over 150 years.

THE OBJECTIVE

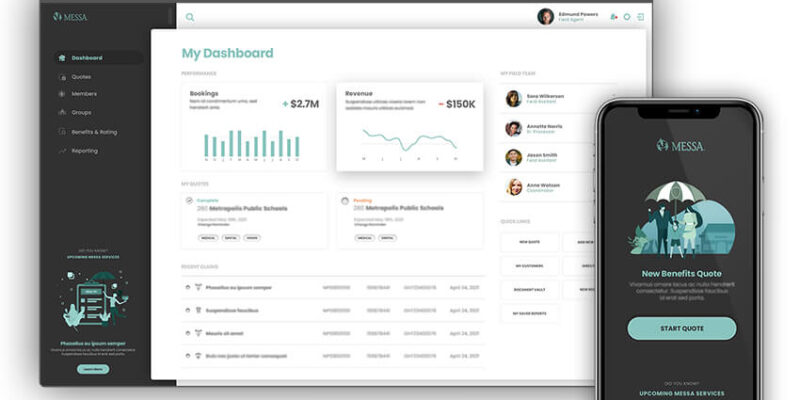

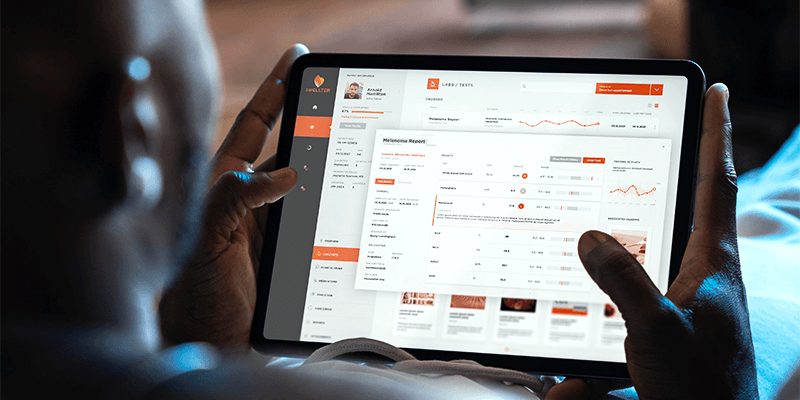

This Master Data Management program was undertaken to centralize, connect and manage customer data to improve customer experience, enable behavior insights and enhance business processes across the enterprise while also protecting and securing the business.

The goal of the program was to develop capabilities around data stewardship, data quality management, connectivity and integration, centralized data management and data governance and protection.

THE CHALLENGES

BUSINESS IMPACT

X by 2 delivered a MDM architecture roadmap and strategy for improved business and data management capabilities, while also enhancing customer experience.

Untitled

Automated

data quality checks

Untitled

Empowered data users

with clean, complete data

Untitled

Scalable, secure, and flexible

cloud-native data quality solution

Untitled

Accurate customer

identification

Untitled

Better targeting for

up/cross-selling

Untitled

Improved customer

experience

Untitled

Optimized business

processes

CONTACT US

Talk to an Expert.

X by 2 helps insurers use data analytics to improve operations, enable new technologies and improve customer experience.